Retirement Series #3: Start Early

Why the Earliest Dollars Buy the Most Pre-tirement Freedom

📌 The Quick Hit

Retirement is a gradual process that starts now.

The common myth is that we can “catch-up” on saving later in life, when incomes are higher.

Adopting a “pre-tirement” mentality buys you the greatest gift → optionality.

Retirement is less a “financial goal” and more of a dependency problem.

If you had the chance to read the past two articles in this series, you will see that my theory consists of a “pre-tirement” approach to investing for the long-term.

Originally, this edition in the series was going to focus on being aggressive when young. Instead, I felt it worth talking about starting early.

Most people think retirement is something you arrive at. A date. A number. An escape from endless meetings and muted microphones.

Pre-tirement quietly argues something else:

Retirement isn’t an event - it’s a slope. And the slope begins far earlier than anyone admits.

🦄 The Comfortable Myth

The common story goes like this: “I’ll focus on living now, and later I’ll get serious about investing.”

This sounds reasonable. But it happens to be catastrophically wrong. Not morally wrong. Mathematically wrong.

Because investing early isn’t about becoming wealthy sooner - it’s about becoming unconstrained sooner.

That’s the pre-tirement distinction.

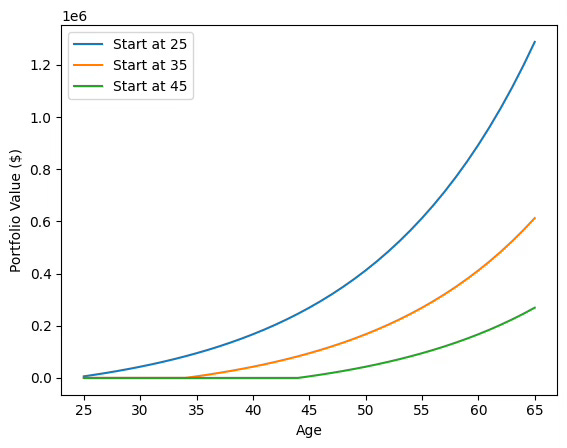

📈 The Chart That Ruins the Illusion

Imagine three investors. Same discipline. Same annual contribution ($6,000). Same returns (7%, roughly long-run equity reality, after inflation but before taxes).

The only difference? When they begin.

One starts in their mid-20s

One waits until their mid-30s

One postpones until their mid-40s

Fast forward to traditional retirement age.

The early starter ends with $1.3m - more than double the wealth of the second ($610k) - and nearly five times that of the third *($275k).

No genius required. No stock-picking magic. Just getting invested and allowing time do its quiet work of compounding.

Here’s the uncomfortable truth:

Most of the money is made in the final decade - but only because of what happened in the first one.

⚠️ The Cruel Paradox

The investor who starts earliest:

Takes less annual risk

Needs less return

Can stop contributing earlier

Has more margin for mistakes

The late starter must:

Save more

Take more risk

Hope markets cooperate

Behave perfectly

Time, not talent, carries the load. Time absorbs failures.

What’s more, for the late starter to “catch-up” to the early starter requires saving almost 5x the amount.

🔑 What a Pre-tirement Approach Actually Buys You

Early investing doesn’t purchase early retirement. It purchases optionality. The cornerstone of pre-tirement.

That shows up as:

The ability to change jobs without panic

The freedom to reduce hours without fear

The courage to say no without needing permission

The luxury of patience - financial and psychological

By your 40s, this optionality feels less like wealth and more like a breath of fresh air.

🔎 The Other Side of Obvious

We’re told retirement is a financial goal. It’s not.

I think it’s a dependency problem.

Pre-tirement is the gradual reduction of that dependency - on employers, markets, luck, or perfect timing.

The earlier the process begins, the gentler it becomes. Start late, and retirement feels like a cliff. Start early, and it becomes a long, almost unnoticeable descent.

👉 Practical (and Powerful) Takeaways

Your first dollars are the most important you’ll ever invest

They compound longest and forgive you most.

Pre-tirement begins the moment investing becomes automatic

Not large. Automatic.

Aim for optionality, not age-based milestones

Freedom is cumulative, not calendar-bound.

If you’re late, don’t despair - but don’t romanticize delay

Urgency isn’t panic. It’s clarity.

✨ Closing Thought

Retirement planning usually asks: “How much will I need?”

Pre-tirement asks a better question:

“How soon do I want my future self to stop being trapped by my past decisions?”

The answer, inconveniently, is almost always: Earlier than we started.

🚀 Up Next:

Sunday - The Impact of AI on U.S. Healthcare

Thursday - Retirement Series #4: Your Greatest Legacy

This publication is for brains, not bets. The Other Side of Obvious shares ideas, stories, and general financial information - not personalized investment, tax, or legal advice. Investing comes with risk (including losing money). Talk to a pro before you act. Please take time to read these important disclosures before you get started.