How to Design a Model Portfolio

And ways to revive it over time.

📌 Quick Hit

Start with a benchmark → your blueprint.

Layer diversification → allocation, geography, size, style, sector.

Large portfolios → use stocks + ETFs for precision.

Smaller portfolios → simple ETFs (S&P 500, NASDAQ).

Revive regularly → rebalance, review sectors, check assumptions.

A model portfolio gives you both a compass and a toolbox. It keeps you on track, while giving you the flexibility to adjust as markets (and your life) evolve.

✨Why Models Matter

Last week we looked at how “global thinking” helps to create strong portfolios. This week, let’s put that into action and design a model portfolio that’s both a blueprint and a living, breathing structure you can adjust as markets shift.

Reduce chaos – no more random stock picking.

Custom-fit risk – models adjust to your tolerance.

Adapt over time – models are flexible; they evolve as your views shift.

🗺️ The Blueprint: Benchmarks

No one builds a house without blueprints. In investing, that blueprint is called a benchmark - a standard you measure against.

Benchmarks do three big jobs:

Provide a blueprint for building your portfolio.

Act as a measuring stick for performance (are you ahead or behind?).

Serve as a course corrector if you veer off strategy.

Are they required? No. But not having one is like driving across the country without a map.

A benchmark is basically like a stock market index. Some indices are good (like the S&P 500) and some not so good (like the Dow Jones Industrial Average).

For global portfolios, the MSCI World Index - an index of all large stocks in developed markets - is a strong starting point. If you want to stay U.S.-only, you could choose US-focused indices like the S&P 500, Russell 2000 or similar.

👉 Think of the benchmark as your “North Star”. It doesn’t dictate every decision, but it keeps you from drifting.

✋ Assumptions Before We Build

For this exercise, let’s assume:

Assets are “investable” (not needed for 18–24 months).

Investor has gone through a suitability check.

Objective is long-term growth with no cash flow needs for 10+ years.

Investor is risk-aware but willing to take risk for long-term goals.

🛳️ Model Portfolio: Larger Assets

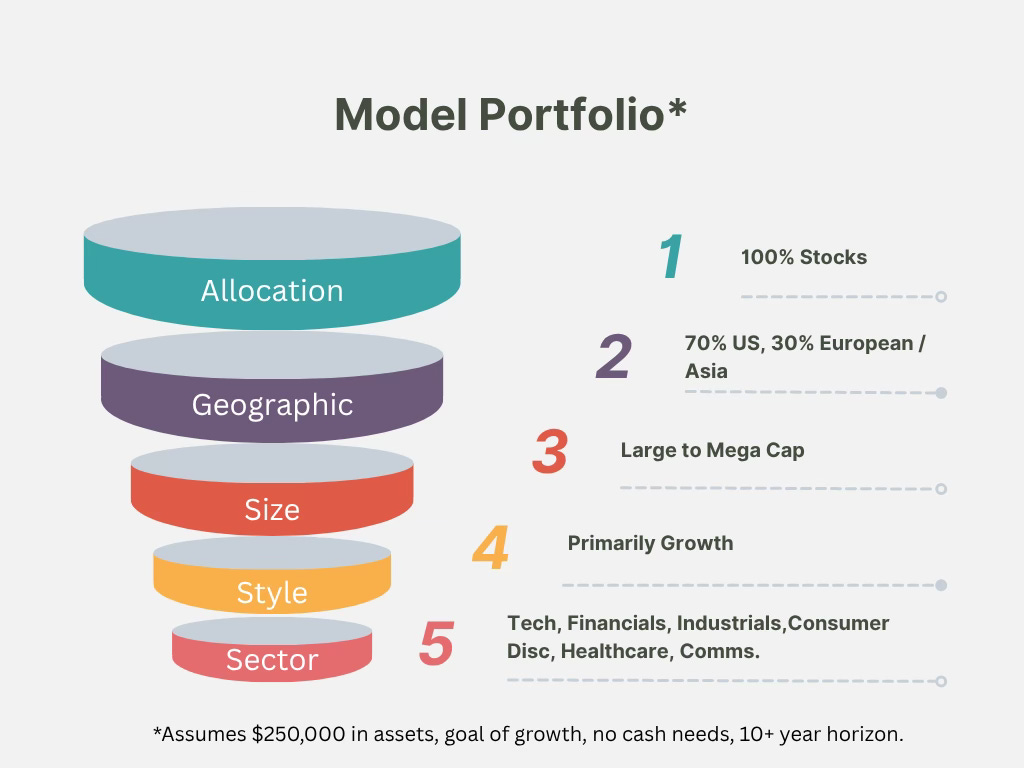

First, let’s look at a larger portfolio (say $250,000 or more). We’ll apply the five diversification layers:

Allocation Layer: 100% stocks + 2–3% cash.

Geographic Layer: 70% U.S., 30% Europe/Asia.

Size Layer: Large/mega-cap focus (especially late in a bull cycle).

Style Layer: Mostly growth, with a mix of value and momentum.

Sector Layer (example distribution as approximately held in the MSCI World Index):

25% Technology

20% Financials

10% Industrials

10% Consumer Discretionary

10% Healthcare

10% Communication Services

5% Consumer Staples

5% Energy & Utilities

5% Materials / Real Estate

⚖️ The “Tilt” Decision

Once you’ve set your benchmark, you ask: do I want to match it, or try to beat it?

For example: if you believe technology will continue to be strong, you might “overweight” tech (buzzword = buy more tech than the benchmark holds). So, instead of 25% technology stocks, maybe 30% or more.

But beware: overweighting raises both potential returns and volatility. (💡Recall the “Eggs and Baskets Dilemma.”)

For large portfolios, you can mix individual stocks with ETFs. ETFs are especially useful for broad sector, size, or geographic exposure.

🚤 Model Portfolio: Smaller Assets

Here, simplicity wins. You don’t need every layer when managing a portfolio under $250,000.

A U.S.-only approach can achieve diversification through broad ETFs.

S&P 500 ETF = size, style, and sector in one wrapper.

NASDAQ ETF = technology tilt.

Fewer moving parts = easier to manage, and still powerful for long-term growth.

🛟 Reviving a Portfolio Over Time

Here’s the key: a model portfolio isn’t a set-it-and-forget-it plan. It’s a living structure.

Ways to keep it alive:

Rebalancing: Periodically (quarterly or annually) trim winners and add to laggards to keep your target mix.

Review sectors: If a sector looks overvalued, trim exposure. If one looks undervalued, add modestly.

Check assumptions: Your time horizon, risk tolerance, and cash flow needs may change. Update your model accordingly.

Revisit benchmarks: If you started global but shifted toward U.S.-only, change the benchmark to reflect reality.

🏡 Closing Thoughts

Think of your portfolio like a house. The blueprint keeps it standing, but over time the paint fades, the roof leaks, and tastes change.

A model helps you know what to patch, what to remodel, and what to leave alone. You don’t need a brand-new house every market cycle - just regular upkeep to keep it strong, livable, and ready for whatever weather comes next.

Have a question? Feel free to direct message me with the button below.

🚀 Next Up:

Sunday - “Why ‘Herd Mentality’ is So Mental”

Thursday - “Don’t Compound Your Problems”

This publication is for brains, not bets. The Other Side of Obvious shares ideas, stories, and general financial information—not personalized investment, tax, or legal advice. Investing comes with risk (including losing money). Talk to a pro before you act. Please take time to read these important disclosures before you get started.

Thank you for today’s post. I appreciate the clarity and structure you brought to the topic. I do have a question: When building the portfolio, how do you decide the ideal number of holding, enough for diversification but not so many that it loses focus?🙏