Why U.S. Healthcare Is in Trouble

And Why This Was Never an Accident

📌 The Quick Hit

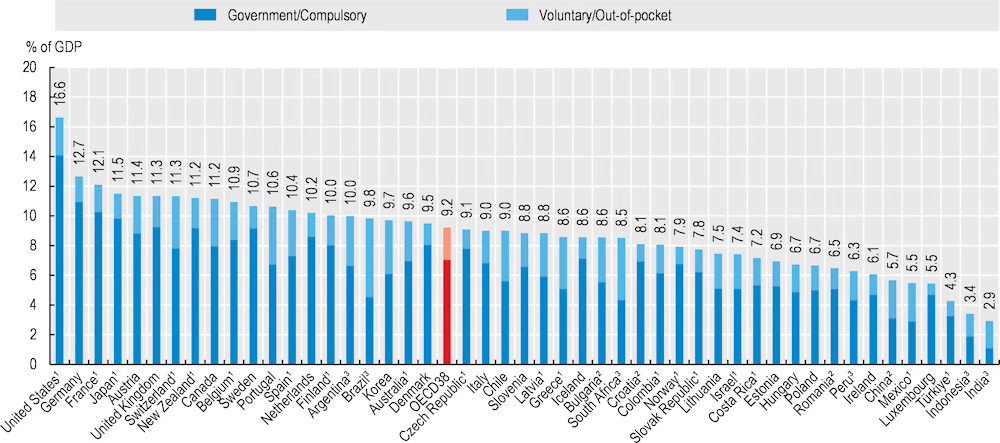

The U.S. spends far more on healthcare than any peer nation - nearly 18% of GDP - yet delivers mediocre outcomes by OECD standards.

This is not primarily a problem of how much care Americans consume, but how much that care costs.

Other modern nations treat healthcare as a utility; the U.S. treats it as a commercial bazaar.

Ironically, the U.S. already centralizes and regulates pricing in many other critical sectors - just not civilian healthcare.

The result is predictable: price inflation, fragmentation, and institutional inertia.

👓 A View from the Outside Looking In

I had the distinct privilege of living and working in Europe for the past six years. My time in Europe spanned both pre- and post-COVID. During that time, I experienced comprehensive, high-quality, low-cost healthcare - delivered without drama, surprise invoices, or financial brinkmanship.

What struck me most was not clinical quality, but philosophy.

In many countries, healthcare is viewed as a public utility: essential, systemically important, and too consequential to be left to uncoordinated commercial bargaining.

In the U.S., by contrast, healthcare evolved into a patchwork marketplace - an ecosystem of insurers, hospital systems, pharmaceutical firms, device makers, billing intermediaries, and administrators, each extracting “value” from the same patient encounter.

This is not a moral judgment. It is a structural observation.

The oh so obvious conclusion - U.S. healthcare is in trouble.

And, what’s more, I think a “solution” is right in front of us. More on that later.

💸 The Spending & Coverage Paradox

The U.S. devotes nearly 18% of GDP to healthcare. Most wealthy nations cluster between 9% and 12%. And yet, outcomes - life expectancy, chronic disease burden, maternal mortality - consistently lag those of peer nations in the OECD.

If money were the cure, America would be the healthiest country on earth.

It isn’t.

A common misunderstanding deserves quick disposal:

“Universal coverage” ≠ “single-payer.”

But both approaches dramatically reduce cost volatility.

Every peer nation ensures baseline coverage for all citizens. This reduces administrative churn, minimizes late-stage interventions, and prevents cost-shifting between payers.

The U.S. does the opposite.

Coverage is fragmented across employer plans, Medicare, Medicaid, ACA exchanges, and private individual markets - each with distinct rules, contracts, billing codes, and negotiated prices. Administrative overhead flourishes in this environment. So do inefficiencies.

Plenty of coverage - little coordination.

⚠️ Prevention vs. Intervention

Most peer nations emphasize primary care and prevention. The U.S. emphasizes specialty care and high-intensity intervention.

Think of it this way:

Other countries maintain the car. The U.S. replaces the engine - repeatedly.

This bias toward intervention is lucrative. It is also expensive, reactive, and poorly suited to managing chronic disease.

🩼 Outcomes Per Dollar: The Achilles Heel

Despite prodigious spending, U.S. outcomes routinely disappoint:

Lower life expectancy

Higher infant and maternal mortality

More preventable hospitalizations

Wider access disparities

Other nations deliver more health per dollar through coordination, pricing discipline, and national planning.

If American healthcare is a sprawling bazaar, peer systems operate more like well-run utilities - less chaotic, less costly, and often more effective.

🤑 Prices: The Real Culprit

Healthcare costs have risen steadily for decades, regardless of political cycle.

OECD analysis of a standardized “basket” of healthcare services reveals:

The U.S. pays roughly 50% above the OECD average for the same bundle.

Countries with stronger price regulation - France, Spain, Slovenia - often pay below the average.

👉 Takeaway: The U.S. cost gap is driven less by volume than by price.

Hospital Care: A Stark Contrast

Comparative studies of patients with complex chronic illness show:

Average hospital spending of roughly $30,900 in the U.S.

About $10,900 in England

That’s nearly three times the cost for broadly comparable care categories.

Prescription Drugs: A Familiar Story

Americans pay dramatically more for medications:

Ozempic: roughly $936 in the U.S. vs ~$148 in Canada (recent data).

Per-capita drug spending in the U.S. far exceeds OECD norms.

Why? Because the U.S. historically allowed manufacturers to set prices without national negotiation for most of the population. Many peer nations do not.

The Trajectory Gets Worse

Projections suggest:

Healthcare spending growth of ~5.8% annually

GDP growth of ~4.3%

Result: healthcare’s share of GDP rising from ~17.6% (2023) to ~20.3% by 2033.

The math is unforgiving.

Why This Matters

A rising healthcare share of GDP has broad implications:

Public finances (government budgets and debt pressures).

Employer costs and wage stagnation.

Household budgets (premium and out-of-pocket spending).

Innovation incentives and market structure.

Countries with centralized price negotiation and budgetary controls (many OECD peers) maintain healthcare proportions much lower — often ~9–12% of GDP — suggesting that systemic design matters deeply.

🎯 Let’s Get Real

“The U.S. Government needs to do more!” Perhaps. But realism matters.

The pharmaceutical, insurance, and healthcare lobbies are among the most powerful in Washington. Meaningful reform threatens entrenched revenue streams. Political will is thin where incentives are misaligned.

And yet - here’s the irony - the U.S. government already does centrally regulate and negotiate prices in many other critical sectors.

Where the U.S. Centralizes - and Why That Matters:

Defense Procurement

The Pentagon negotiates prices, caps profits, and enforces federal acquisition rules. No contractor simply “names their price.”

Energy & Utilities

Electricity and natural gas operate under regulated-return models. Rates are approved. Margins are constrained.

Transportation Infrastructure

Aviation, rail, and highways follow national standards with coordinated funding and oversight.

Pharmaceuticals for VA & DoD

The U.S. government negotiates drug prices aggressively - often 40–50% below commercial rates - for veterans and active military.

Agriculture

Price supports, subsidies, inspections, and strategic reserves stabilize markets deemed essential.

Communications Spectrum

Managed, auctioned, and regulated by the FCC - not a free-for-all.

Strategic Materials

Rare earths, petroleum reserves, and critical minerals are monitored, stockpiled, and governed under national-security logic.

Public Health Emergencies

COVID showed the U.S. can centrally negotiate, procure, and distribute healthcare resources when survival is at stake.

👉 The Pattern Is Hard to Miss

The U.S. centralizes what it deems strategic, systemically essential, or vulnerable to monopoly abuse.

Healthcare, astonishingly, was allowed to evolve outside this framework.

The result is a hybrid system of:

Local hospital monopolies

Private insurers with opaque contracts

Fragmented public payers

Which explains why rare earth pricing is treated as a national-security issue - while an MRI can cost five to ten times more in California than in Spain.

⁉️ The Real Question

No one disputes that U.S. healthcare needs reform.

The harder question is how reform actually happens.

History suggests politicians rarely lead structural change. They respond to pressure -especially pressure originating outside the system.

So where does that pressure come from?

That question - and the role of AI as a potential catalyst - will be the subject of Part II.

🚀 Up Next:

Thursday - Retirement Series #3: Be Aggressive When You Are Young

Sunday - The Impact of AI on U.S. Healthcare

This publication is for brains, not bets. The Other Side of Obvious shares ideas, stories, and general financial information - not personalized investment, tax, or legal advice. Investing comes with risk (including losing money). Talk to a pro before you act. Please take time to read these important disclosures before you get started.