Why Almost 50% of Adults Don't Invest

Spoiler Alert: It's Not What You Think.

📌 The Quick Hit

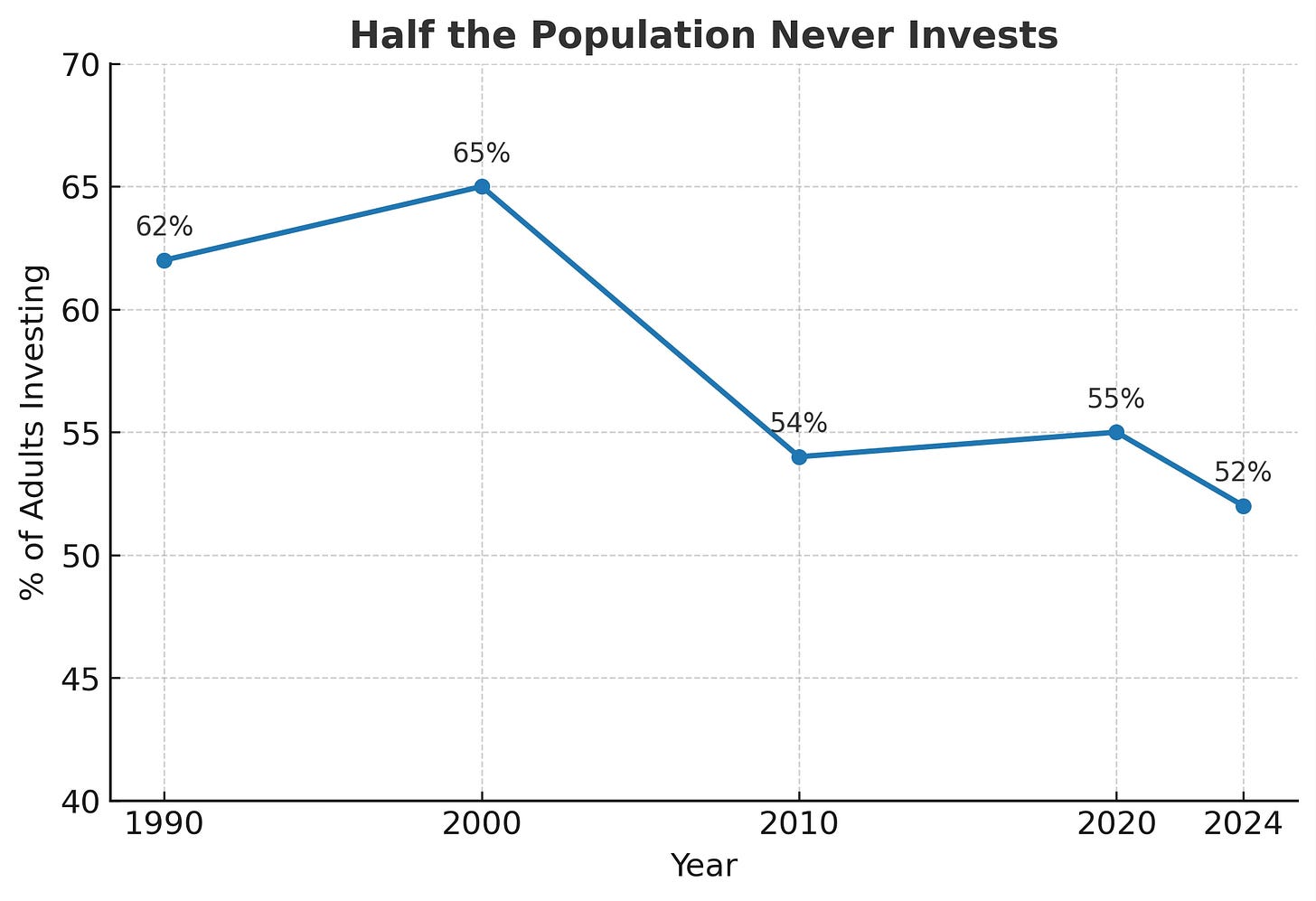

Almost half of adults never invest in stocks, bonds, or other capital markets.

The usual suspects—fear, mistrust, lack of knowledge—are real, but they’re symptoms.

After 25 years in the industry, I believe the real obstacle is a much deeper beast: the part of us that fears being wrong more than missing out.

Investing with clarity and confidence requires taming that beast.

📈 The Missed Opportunity of a Lifetime

We’ve just lived through one of the greatest wealth-creation periods in history.

Yet, nearly 50% of adults fail to invest in capital markets (buzz word = stocks, bonds, etc), not because they couldn’t, but because they never took the first step.

Not surprisingly, this is also true in most countries, including the UK.

🧨 The “Obvious” Barriers

Most surveys highlight at least 5 common roadblocks:

1. Lack of knowledge & confidence

2. Mistrust of markets or advisors

3. Fear of loss or volatility

4. Perceived complexity

5. Low financial literacy

💡 Reality check: These are real, but they’re not the root cause. Legitimate or not, These are the excuses our minds feed us.

💡 The Real Barrier?

It’s pretty much the same old thing that’s been going on for millennium.

During my decades working in the investment industry, I have heard almost every reason (or excuse) in the book for not getting or staying invested.

The biggest roadblock isn’t fear itself—it’s Ego.

Ego fuels emotions and flames fear. (And greed. More on that at another time.)

A lot of people think “pride” is about having a big ego! Sometimes. But it is often much more subtle.

Ego whispers:

• “I can’t afford to be wrong.”

• “I’ll start when I’m sure it’s safe.”

• “I’ll wait until I know more.”

Ego wants control. To avoid embarrassment.

Investing means giving up control over outcomes.

It’s humbling—and that’s why many people never even start. Or start, then get stuck.

🔑 What Successful Investors Do Differently

Even the best make mistakes. Including Warren Buffet.

They succeed by:

Taming ego by being realistic about our ability to control outcomes

Calling losses what they are (not personal failures)

Reflecting, regrouping, and restarting

Focusing on probabilities, not perfection

Anchoring everything on long-term outcomes (we’re talking decades)

Ignore the urge to brag when they make gains

📊 A 70% win rate in investing is exceptional. The only sure way to fail is not to invest at all.

But most of all, they learn how to moderate their pride. (Note: you can’t negotiate with your ego. You have to tame it into submission.)

✅ A Quick Self-Check

Start here. Do some personal fact-checking. Ask Appropriate Questions.

Such as:

If I had $X I didn’t need for 1–2 years, what would I do with it, right now? Then ask, “why?” or “why not?”

If I lost some or most of it in the market, how would I respond? Why?

Which barrier is mine—fear, complexity, or mistrust?

What do I think is behind those investing barriers?

How has this barrier(s) impacted my investment decisions?

💬 If you are up for it, feel free to leave a comment about your personal fact-check experience. (FYI: you can also DM me in the Substack app.)

👉 Why This Matters

If your goal is to grow your liquid wealth—or simply keep up with inflation—you’ll likely need to invest.

And, don’t forget, we are living much longer these days - none of us want to outlive our ability to enjoy those extra years!

Most importantly (to me, anyways) is growing as a person. Ego is a growth killer.

And, what’s the point of being wealthier if I am not growing personally, along side it? Our true value is not found in the size of our material wealth!

Maybe you have already learned how to tame your ego - that should serve you well.

And, plenty of people invest without checking (and taming) their ego. But from my perspective, the road is much, much harder!

😉 Final Word (And a Wink)

I started The Other Side of Obvious to help people think differently about money and meaning—because the obvious answer isn’t always the best one.

Facts and figures help, but the real skill is outsmarting your own ego.

This ability does more than help you to become a wise investor. It translates into every part of your life.

How? Stay tuned and each week I will walk you through, step-by-step.

🍞 Remember: Money left in the bank is like bread left in the oven—it’s safe, but it’s not rising.

🚀 Up Next:

Thursday - “The Eggs and Baskets Dilemma”

Sunday - “Not All Fear is Created Equal”

This publication is for brains, not bets. The Other Side of Obvious shares ideas, stories, and general financial information—not personalized investment, tax, or legal advice. Investing comes with risk (including losing money). Talk to a pro before you act. Please take time to read these important disclosures before you get started.