"Time Is Money!" (Or So We Thought)

How the Markets Think About Time

📌 The Quick Hit

We’ve all heard the saying, “time is money.”

But in investing, that phrase misses the mark.

Money can be earned, lost, and earned again. Time can’t.

Markets don’t care about your timing or your impatience to “make it.”

They reward patience, consistency, and staying power, not clever exits or Reddit-fueled luck.

Bottom line: Time in the market beats timing the market - every time.

🕰️ The Myth of “Time Is Money”

“Time is money.”

It’s printed on mugs, stitched on pillows, and shouted across office floors.

Sure, wasted time costs something.

But here’s the truth:

Time is far scarcer than money.

You can lose money and earn it back.

You can’t lose time and get a refund.

So if time is the rarer currency… why do we invest like it’s expendable?

📉 The Market Isn’t Waiting for You

Three uncomfortable truths:

🕒 Markets have no concept of time - especially yours.

They don’t care if you’re “ready” to make money.

🎩 Timing the market is a magician’s trick and you’re not the magician.

Getting in and out perfectly? Luck, not skill.

📈 Time in the market beats timing the market.

Every decade. Every study. Every time.

And yet… most investors keep trying to outsmart the clock.

⚡ The Curse of “Get Rich Now” Thinking

We live in a dopamine economy.

Thirty-second TikToks promise financial freedom. Meme stocks “guarantee” overnight wealth.

We crave speed.

But let’s be honest - the few legal ways to make money quickly are:

🚀 Luck (lottery, meme stocks, inheritance)

🧨 Risk (options, leverage, speculative bets)

Even if you hit a home run once → can you repeat it?

Didn’t think so.

If your success can’t be repeated, it wasn’t a strategy — it was a fluke.

💬 Real Talk: A Conversation About Timing

Friend: “I’m thinking about buying shares of ‘Really Great Company,’ but is now the right time? At $125, it feels too high.”

Me: “Okay, what price would feel better?”

Friend: “Maybe $85…”

Me: “So, about 40% lower?”

Friend: “Right.”

Me: “For it to drop that much, something big would need to happen: a bear market, meltdown, or scandal. Would you feel confident buying then?”

Friend: “Uh, not really.”

Me: “So, if you believe in it and it fits your plan, what should you do?”

Friend: “Buy it.”

And there it is.

We want to buy low, but never feel good when prices are low.

Fear clouds logic. Certainty disappears.

And while we wait for “the right time”… time moves on without us.

🪴 The Boring, Beautiful Power of Time

Patience is hard.

It’s the broccoli of investing - good for you, but rarely celebrated.

But the math doesn’t lie. The longer the period of investment, the better the outcome.

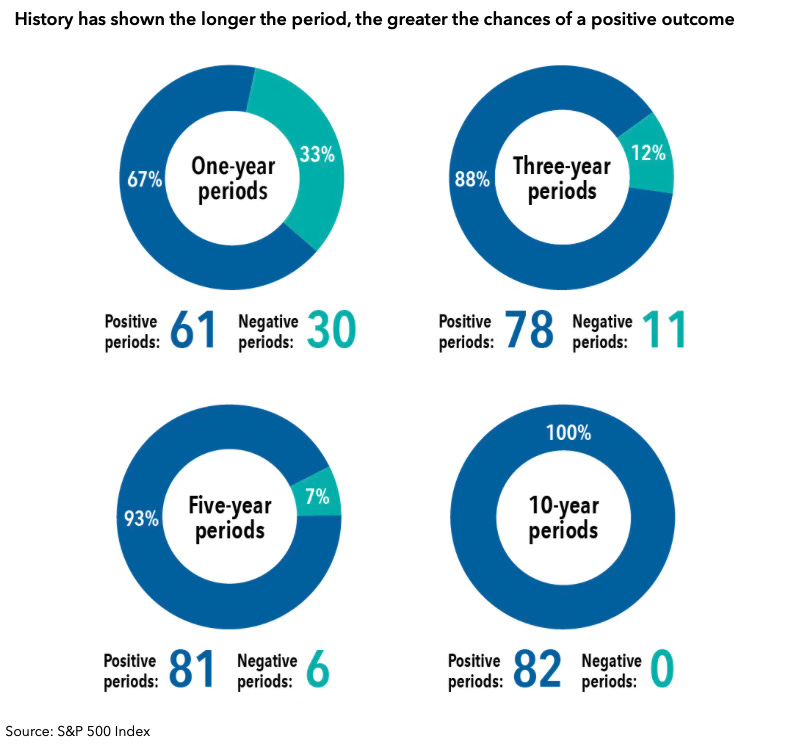

Consider the S&P500:

Over the last 91 years, one-third of market years were negative.

Yet 100% of 10-year investment periods in the S&P 500 have been positive.

Much less if you invested for 1-year periods.

Guess what happens when we spend time out of the market…

Missing just the 10 best days in the market can cut your total return in half! (Sources: Capital Group, Vanguard, AQR).

The kicker?

Those “best days” often happen right after the worst ones.

If you step out to avoid pain, you likely miss the payoff.

The market rewards time, not timing.

📚 Investing Wisdom vs. Financial Knowledge

You can memorize Buffett quotes.

Read every investing book.

Subscribe to every newsletter (even this one 😉).

But until you understand your own relationship with money, it’s all just trivia.

Ask yourself:

Do I crave control?

Do I chase validation through winning trades?

The market exposes every emotional bias (with interest).

Financial wealth comes from facts, models, and systems.

Financial wisdom comes from understanding yourself.

And that… takes time.

💡 Investing is less about what you know and more about how long you can stay wise.

🪞 The Takeaway

Next time you hear “time is money,” flip it around.

Money is renewable.

Time is not.

Treat time like the rarest investment in your portfolio.

Because you can’t rush compounding - you can only get out of its way.

💭 The Compound Interest of Patience

If money compounds through interest, wisdom compounds through patience.

Every day you stay invested — in the market and in your learning — your future self earns the dividend.

So stop watching the clock.

Stop refreshing the charts.

It’s not about when you make your money —

It’s about how long you let it work for you.

After all, time may not be money…but it’s the one investment you can never afford to lose.

🚀 Up Next:

Thursday - “Your Gut is Clueless!”

Sunday - “Abundance v. Scarcity Mindset”

This publication is for brains, not bets. The Other Side of Obvious shares ideas, stories, and general financial information—not personalized investment, tax, or legal advice. Investing comes with risk (including losing money). Talk to a pro before you act. Please take time to read these important disclosures before you get started.

Thanks Sean, this one really got me thinking! Which investing principles apply best when we think about how we use our time?