The Truth About the U.S. Deficit (Part 1)

Who Actually Holds U.S. Debt?

📌 The Quick Hit:

Everyone talks about foreign countries “owning America.” The truth is: the biggest holder of U.S. debt is not China or Japan.

U.S Treasuries remain the most reliable global benchmark for safety and liquidity.

❓An Unusual Investment Decision

There was a curious headline out of the Chicago Sun-Times this week.

The Chicago Treasurer announced that the city’s $10 billion investment portfolio would stop buying U.S. Treasury bonds.

In total about 2% of the portfolio would go elsewhere. Still, the point is made.

Regardless of your politics, that’s a remarkable statement. A local government refusing to lend money to its own national government - apparently out of protest -invites a few unsettling questions:

“What if other investors follow suit?”

“Doesn’t China already own most of our debt anyway?”

NOTE: This publication remains politically agnostic. Politics cloud investment sense.

But the question “Who actually holds U.S. debt?” deserves a fact-based look.

🏛 How the U.S. Finances Itself

Whenever Washington spends more than it collects in taxes, the Treasury steps in to plug the gap.

It does this by issuing Treasury securities - IOUs backed by the “full faith and credit” of the United States.

These come in different flavors:

T-Bills (short-term)

T-Notes (2–10 years)

T-Bonds (20–30 years)

TIPS (inflation-protected)

Investors buy them because they’re among the safest income-producing assets on earth.

So yes - when the Treasury borrows, it’s effectively crowdfunding the U.S. government through global investors, pension funds, banks, and even you (if you hold a Treasury fund in your IRA).

🧨 What If Foreign Buyers Stop Purchasing?

Whether its stocks or bonds, demand drives price. If big buyers like China or Japan stopped purchasing Treasuries, yields would rise, borrowing would become more expensive, and financial headlines would scream “Crisis!”

Yet despite political friction, they keep buying. Why?

Because for all of America’s flaws, (and regardless of geo-political backbiting) U.S. Treasuries remain the world’s gold-standard collateral - liquid, safe, and backed by the largest economy on earth.

📊 The Untold Truth: America Owns Most of Its Own Debt

Let’s separate myth from math.

As of September 2025, total U.S. federal debt stands around $37.4 trillion, split into:

$30.1 trillion held by the public, and

$7.3 trillion held internally by the government itself (Social Security, Medicare, federal pensions, etc.).

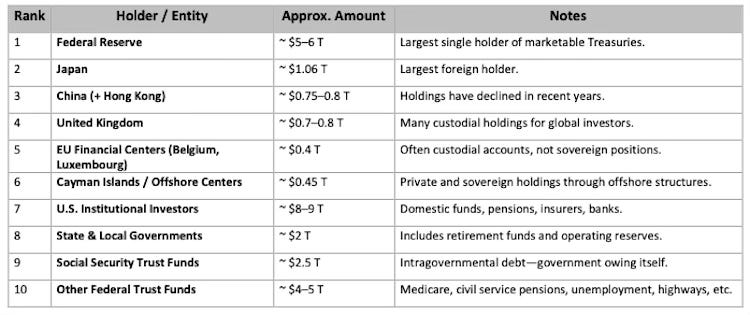

Here’s how the major holders stack up:

💡 Investor Takeaways

The U.S. isn’t “owned” by foreign nations.

Roughly three-quarters of Treasury debt sits in American hands.

Treasuries remain the global benchmark for safety and liquidity.

Even critics rely on them for stability and collateral.

Debt dynamics matter, but ownership matters more.

When most of your debt is owed internally, your risk profile looks very different from a country reliant on foreign creditors.

For individual investors:

Treasury yields anchor bond markets and influence everything from mortgages to stock valuations.

Watching shifts in Treasury demand (especially by the Fed and large institutions) can offer clues about future interest-rate moves.

Next week, we’ll tackle another U.S. debt “myth”: Why the U.S. deficit isn’t always the monster it’s made out to be.

🚀 Up Next:

Sunday - “How to Filter Noise From News”

Thursday - “The Truth About U.S. Deficits (Part 2)”

This publication is for brains, not bets. The Other Side of Obvious shares ideas, stories, and general financial information—not personalized investment, tax, or legal advice. Investing comes with risk (including losing money). Talk to a pro before you act. Please take time to read these important disclosures before you get started.