The Politically Agnostic Investor

How to Game the Election Cycle to Your Advantage

Quick Hit Summary

Political opinions are not investment signals.

Early presidential terms historically carry more volatility and policy risk.

Late-term periods - especially year three - have been the most equity-friendly.

Markets discount fear faster than voters do.

The goal isn’t prediction; it’s probabilistic positioning.

When I began working for Ken Fisher, one lesson arrived early and stuck fast: politics and portfolios should never share the driver’s seat. I gradually learned to become politically agnostic (neutral) when it comes to politics and investing.

Not because politics are irrelevant, but because political attachment corrodes judgment. Once an investor starts rooting, booing, or moralizing, decision-making narrows. Inputs shrink. Risk rises.

Political conviction, when smuggled into investment choices, behaves like an analytic toxin. It crowds out economic data, sentiment, valuation, liquidity, and probability -the very ingredients markets actually digest.

A Recent Reminder

Take 2025. A meaningful cohort of investors dismissed U.S. equities outright due to the Trump factor. When tariff-heavy policies rattled global markets, they felt vindicated. Staying out felt prudent - righteous, even.

Until it didn’t.

As tariff shock morphed into tariff familiarity, markets did what they always do: adapt, discount, and move on. Economic data surprised to the upside. Stocks recovered. Those who’d exited for political reasons paid an opportunity cost that no ideology reimburses.

Personally, I find broad tariff strategies economically clumsy (and unnecessary). BUT, that opinion never touched my portfolio. Experience teaches you this discipline the hard way - often by watching others repeatedly fail to learn it.

Over the years, I saw clients liquidate portfolios because “their party” lost an election. The damage wasn’t philosophical; it was mathematical. Missing recoveries is far more lethal to long-term goals than enduring volatility.

Rather than fight politics, I prefer to use it.

That’s where the Presidential Term Cycle, often mislabeled an “anomaly,” enters the conversation.

The Presidential Term Cycle (Anomaly)

Ken Fisher outlines this pattern clearly in Debunkery and related research (including The Only Three Questions That Still Count). The idea is not mystical. It’s behavioral, institutional, and painfully human.

Presidents face incentives. Markets respond to incentives.

The historical rhythm:

Years 1–2: The Danger Zone

Early terms are legislative heavy-lifting seasons. This is when administrations attempt the boldest redistributions - taxes, regulation, property rights, entitlement reshuffling.

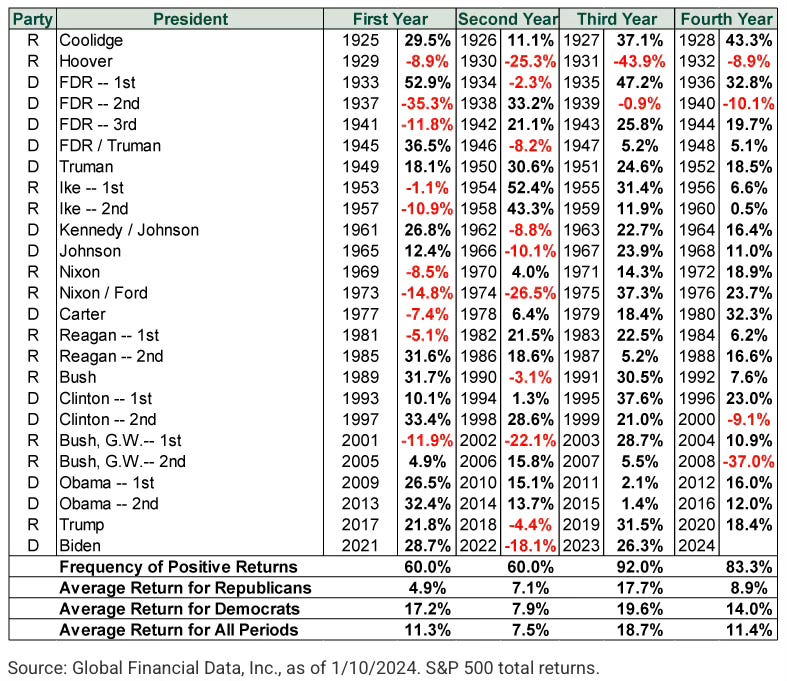

Even when laws fail, the threat of change injects uncertainty. Markets dislike uncertainty more than bad news. Historically, the ugliest drawdowns cluster here (see S&P 500 returns in the chart below).

Two Bad Years Rarely Travel Together

While early-term volatility is common, back-to-back deeply negative years are uncommon. Fear tends to peak early and markets tend to exhaust pessimism faster than headlines do.

Years 3–4: The Sweet Spot

As re-election looms, political incentives flip. Stimulus replaces austerity. Stability trumps disruption.

Year three, in particular, has historically delivered the strongest equity returns of the four-year cycle.

This is not prophecy. It’s pattern recognition across decades of data.

Stocks don’t vote. They respond to policy risk and policy restraint.

How to Become Politically Agnostic as an Investor

Political neutrality doesn’t mean political ignorance. Taxes matter. Regulation matters. Fiscal posture matters. What doesn’t help is emotional allegiance.

Here’s how to operationalize detachment:

First: Separate awareness from attachment.

Stay informed, but audit your emotional temperature. If a policy headline makes you angry or gleeful, pause. Emotion is a signal—not an instruction.

Second: Exploit the system instead of protesting it.

If your preferred candidate loses, resist the urge to sulk in cash. Instead, recognize the cycle. Early-term anxiety often plants the seeds of later gains. Call it electoral arbitrage.

As Fisher likes to say: stocks don’t pick sides. Why should you?

Third: Practice subordination of belief.

This is the hardest step. Humans are narrative animals. Markets are probabilistic machines. The two rarely agree.

Fear - especially politically flavored fear—feels rational in the moment. It almost never is. (There’s ample research showing fear-driven decisions systematically degrade outcomes.)

Before acting on a politically charged impulse, ask yourself:

How does this move me closer to my actual financial goals?

If I’m wrong, what’s the cost - not emotionally, but numerically?

How can I use the Presidential Term Cycle instead of fighting it?

A Closing Thought

You are free to hold strong political views. You are not free from the consequences of letting them manage your money.

The politically agnostic investor doesn’t ignore elections - they monetize them. By subordinating ideology to evidence, and emotion to structure, you give yourself a durable edge.

In markets, neutrality isn’t passivity. It’s leverage.

Up Next:

Thursday - Retirement Series #5: Retire or Get Retired

This publication is for brains, not bets. The Other Side of Obvious shares ideas, stories, and general financial information - not personalized investment, tax, or legal advice. Investing comes with risk (including losing money). Talk to a pro before you act. Please take time to read these important disclosures before you get started.