"No News Is Good News!" Really?

Why Markets Hate Uncertainty More Than Bad News

📌 The Quick Hit

Markets price in what’s known, not what’s unknown.

Uncertainty causes volatility; clarity restores confidence.

Bad news ≠ bear market.

Every bull market climbs a “wall of worry” and the bricks are made of uncertainty.

📰 What Markets Fear

“Markets don’t fear pain. They fear confusion.”

Actually, no news isn’t good news.

No news creates uncertainty. Uncertainty is the market’s least favorite four-letter word.

News itself, even bad news, creates clarity.

It defines the playing field, sets expectations, and lets investors get back to the thing markets do best: pricing the future.

When uncertainty reigns, prices fall - not because the world is ending, but because investors can’t quantify what comes next.

🧭 Why This Matters

The global stock market clocks in around $110 trillion.

The global bond market? Even bigger - about $135 trillion.

Together, they represent humanity’s collective expectations about the future.

When uncertainty creeps in - about policy, inflation, earnings, or war - those expectations blur.

The fog itself becomes the problem.

Investors demand compensation for the unknown, and that compensation comes in the form of lower prices and higher volatility.

⚖️ Bad News vs. Unknown News

Here’s the counterintuitive truth:

Markets move on from bad news faster than from no news.

Once a headline turns into hard data or confirmed policy, markets adjust, price it in, and move forward - often with surprising speed.

As my former boss Ken Fisher likes to say, “Bull markets climb a wall of worry.”

And they always have.

🔍 Three Examples When Markets Feared the Unknown

1. Terror (2001)

After the tragic events of September 11th, the S&P 500 plunged nearly -12%.

Many believed that was the end of the bull market.

But within 19 trading days, markets had regained their pre-attack levels.

There were still huge unknowns about the economy and global stability - yet once the initial uncertainty gave way to known realities, markets did what they do: they moved forward.

2. War (1940s)

At the onset of World War II, U.S. markets fell sharply again when France fell to Germany - a moment many saw as confirmation of global collapse.

But by 1942, a new bull market began - three years before the war ended.

Markets didn’t wait for peace; they priced in what was known about production, policy, and prospects - and moved on.

3. Government Policy (2025 Tariffs)

During the Trump Administration’s tariff announcements, markets swung wildly - not because tariffs were inherently catastrophic, but because no one knew what they would be, who they would affect, or how long they would last.

The details were opaque, guidance inconsistent, and communication chaotic. That lack of clarity - not the tariffs themselves - drove markets lower.

When the rules finally became clear, markets stabilized.

Confusion lifted. Prices normalized.

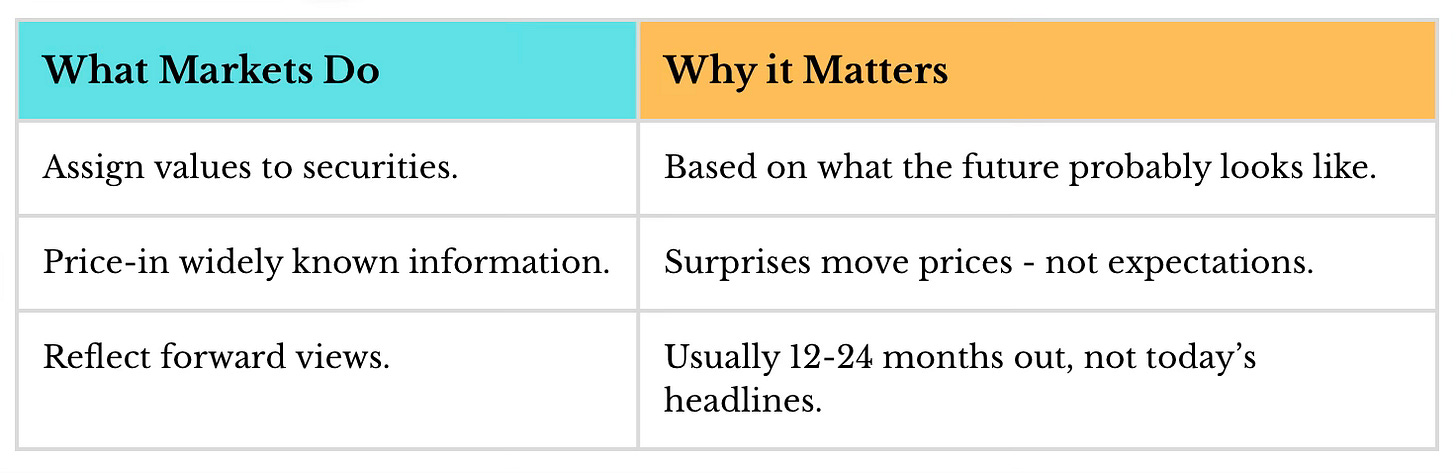

🧮 What Markets Actually Do

Markets aren’t emotional creatures - they’re discounting mechanisms.

They process information, weigh probabilities, and express a forward view in price.

They process news the same way humans process anxiety:

Once we know what we’re dealing with, the fear subsides.

📈 How They Do It

Stock prices move on simple principles of supply and demand.

The number of publicly listed companies is relatively fixed - aside from new IPOs or SPACs - so it’s investor appetite that drives prices higher or lower.

When confidence is shaken and uncertainty clouds the future, demand softens.

When clarity returns, demand strengthens again.

Even during the dot-com bust (early 2000s), when the supply of new stocks exploded beyond what investors could reasonably absorb, the lesson remained the same:

It wasn’t simply bad news that hurt markets - it was the oversupply of uncertainty.

💭 The Takeaway

Markets don’t fear bad news. They fear what can’t be priced.

Volatility is the ‘tax’ investors pay for clarity.

Bad news is normal. On its own, it rarely signals the end of a bull market.

Clarity is bullish. Once we know, we can move on.

So yes - “no news” might sound peaceful.

But in markets, it’s often the loudest alarm.

🚀 Up Next:

Sunday - “Hindsight is Not 20/20”

Thursday - “5 Ways to Double Your Money”

This publication is for brains, not bets. The Other Side of Obvious shares ideas, stories, and general financial information—not personalized investment, tax, or legal advice. Investing comes with risk (including losing money). Talk to a pro before you act. Please take time to read these important disclosures before you get started.

This made me think; can ‘no news’ sometimes just mean things are working as they should?