Abundance vs. Scarcity: The Investor's Dilemma

Why $1 Million Can Feel Like A Loss

📌 The Quick Hit

When your portfolio climbs, for example, from $800K to $1M, you feel like a genius.

When it falls back to $800K, you feel like a failure.

Same number. Different emotion.

Welcome to one of the most fascinating psychological distortions in investing and in life.

The human brain quietly moves the goalposts, converting progress into perceived loss.

That shift, from gratitude to grief, is the essence of the scarcity mindset.

🪤 The Trap: Loss Aversion and the Reference Point Problem

“Losses loom larger than gains.” — Daniel Kahneman & Amos Tversky, 1979

We don’t judge wealth by what we have. We judge it by where we were.

When your account first hit $800K*, it represented expansion.

When it fell back to $800K, it represented contraction.

That’s the reference point trap — the brain quietly upgrades your sense of “normal” with each success, making anything less feel like failure.

(*Note: the size of the portfolio is irrelevant. We feel the same way if our $10,000 portfolio drops to $8,000.)

🔬 The Biology of a Market Pullback

Loss doesn’t just hurt psychologically, it’s physiological.

Brain scans show that financial loss activates the same pain centers as physical injury (the insula and anterior cingulate cortex).

Cortisol rises. Focus narrows. Your scarcity alarm blares.

Your $800K didn’t change. Your brain chemistry did.

Behavioral economists Sendhil Mullainathan and Eldar Shafir call this the bandwidth tax of scarcity: when the mind perceives loss, it tunnels attention, amplifying fear and impulsivity.

😏 The Hedonic Comedown

When wealth grows, you feel awe.

But the brain adapts quickly.

Psychologists call it hedonic adaptation — the process by which today’s thrill becomes tomorrow’s baseline.

Yesterday’s dream is now your bare minimum.

The mind whispers: more. Always more.

The Real Culprit: Identification

You haven’t just lost $200,000 — you’ve lost a story:

“I’m a millionaire.”

When wealth fuses with identity, volatility feels personal.

Abundance starts where identification ends.

“Wealth is not his that has it, but his that enjoys it.”

— Benjamin Franklin

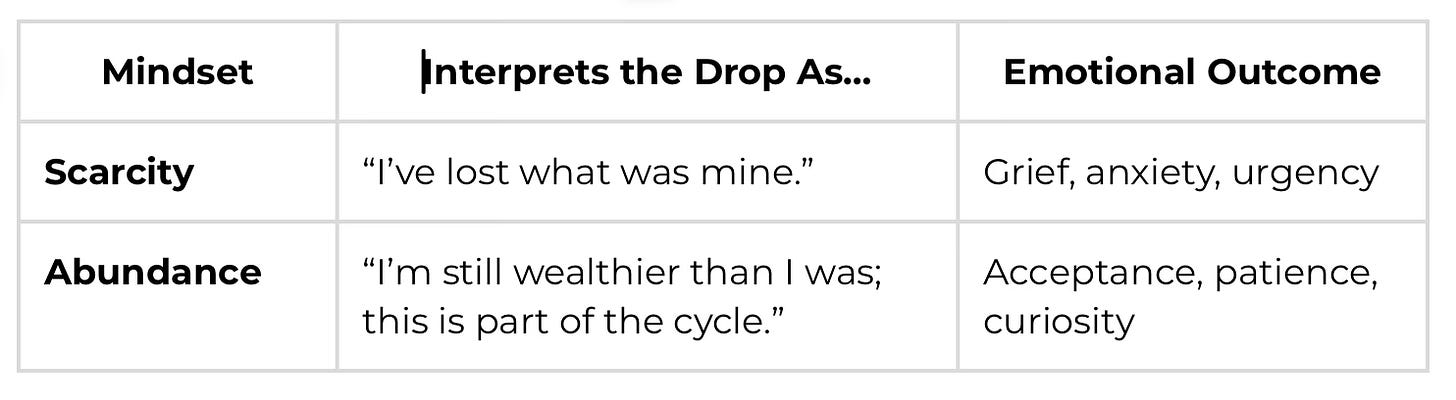

📊 Abundance in Action

Scarcity clings. Abundance flows.

The abundance mindset doesn’t deny volatility - it reframes it as rhythm, not threat.

🧠 How to Rewire the Response

1. Reset your reference points.

Look back monthly to where you started - not where you peaked. You’ll remember that $500K once felt rich.

2. Rehearse volatility.

Great investors like Howard Marks and Annie Duke treat downturns as the price of admission for long-term compounding.

3. Journal gratitude.

It’s not fluff. Gratitude increases dopamine and reduces amygdala activation, widening perspective and restoring calm.

4. Detach identity from numbers.

Your net worth isn’t your self-worth. The market can correct prices, but only you can correct perspective.

5. Expand your time frame.

Scarcity lives in the short term. Abundance lives across decades.

🎯 The Real Lesson

Abundance isn’t the absence of loss → it’s the resilience to loss.

Our minds were made to continually adapt, not stagnate in satisfaction or loss.

But awareness restores balance.

Scarcity whispers, “It could all go away.”

Abundance replies, “Even if it does, I’ll rebuild.”

✨ Closing Thought

You didn’t lose $200,000, think of it as paying volatility’s rent.

And in return, you got to stay invested - not just in the market,

but in the only asset that truly compounds: Perspective.

🚀 Up Next:

Thursday - “No News Is Good News. Really?”

Sunday - “Hindsight is Not 20/20”

This publication is for brains, not bets. The Other Side of Obvious shares ideas, stories, and general financial information—not personalized investment, tax, or legal advice. Investing comes with risk (including losing money). Talk to a pro before you act. Please take time to read these important disclosures before you get started.

Thanks for the share, another gem!💎

How do you tell the difference between healthy caution and a scarcity mindset?