5 Ways to Double Your Money

And How to Lower Your Risk While Doing It

📌 The Quick Hit:

Everyone wants to double their money. Few realize that doing so consistently isn’t about luck, timing, or insider access - it’s about patience, compounding, and smart risk-taking. Let’s walk through the classic (and not-so-classic) ways to double your investments - and what actually works over time.

There are many ways to double your money. Some take longer. Some require more risk.

But thinking through how and why these methods work will reshape the way you grow wealth.

Below are five common ways investors try (and sometimes fail) to double their money - from the seductive to the sound.

🎰 1. Meme Stocks

Nothing says “get rich quick” like a stock with a mascot and a meme.

Meme stocks can double your money - if you time it perfectly, stay glued to Reddit, and accept that you’re gambling, not investing.

The problem? No one brags about the memes that didn’t pop.

The risk-reward equation is brutal: high adrenaline, low repeatability.

Verdict: Entertain yourself with memes. Don’t build your retirement on them.

🏦 2. IPOs (Initial Public Offerings)

Everyone loves a shiny new stock story. Getting in early - before the crowd - sounds thrilling.

But here’s the truth: most IPO access is reserved for insiders or institutional buyers. And even when you do get in, history shows that many IPOs underperform the market within their first year.

That said, being an early stakeholder - through private equity, venture funds, or employee stock programs - can indeed be life-changing.

Verdict: Great for insiders. For the rest of us, temper expectations and stick with proven compounders.

💵 3. Leverage

Leverage simply means using borrowed money to magnify returns. Sounds great…until it magnifies losses.

Types of leverage:

Margin investing: Borrowing against stock you already own.

Asset-backed borrowing: Using real estate or other assets to buy more stock.

Leveraged funds: ETFs or funds that use internal leverage for you.

Leverage can double your money faster. But it can also halve it - instantly. And few things sting more than a margin call in a down market.

Verdict: Handle with extreme care. Leverage accelerates outcomes - both good and bad.

🛤️ 4. Go Narrow

Concentrating your money in a single company, fund, or sector is how fortunes - and disasters - are made.

Warren Buffett himself once said:

“Diversification is protection against ignorance. It makes little sense if you know what you’re doing.”

Concentration magnifies conviction. If you truly understand your investment and can stomach volatility, it’s a powerful tool.

Verdict: Know what you own, why you own it, and how much pain you can tolerate.

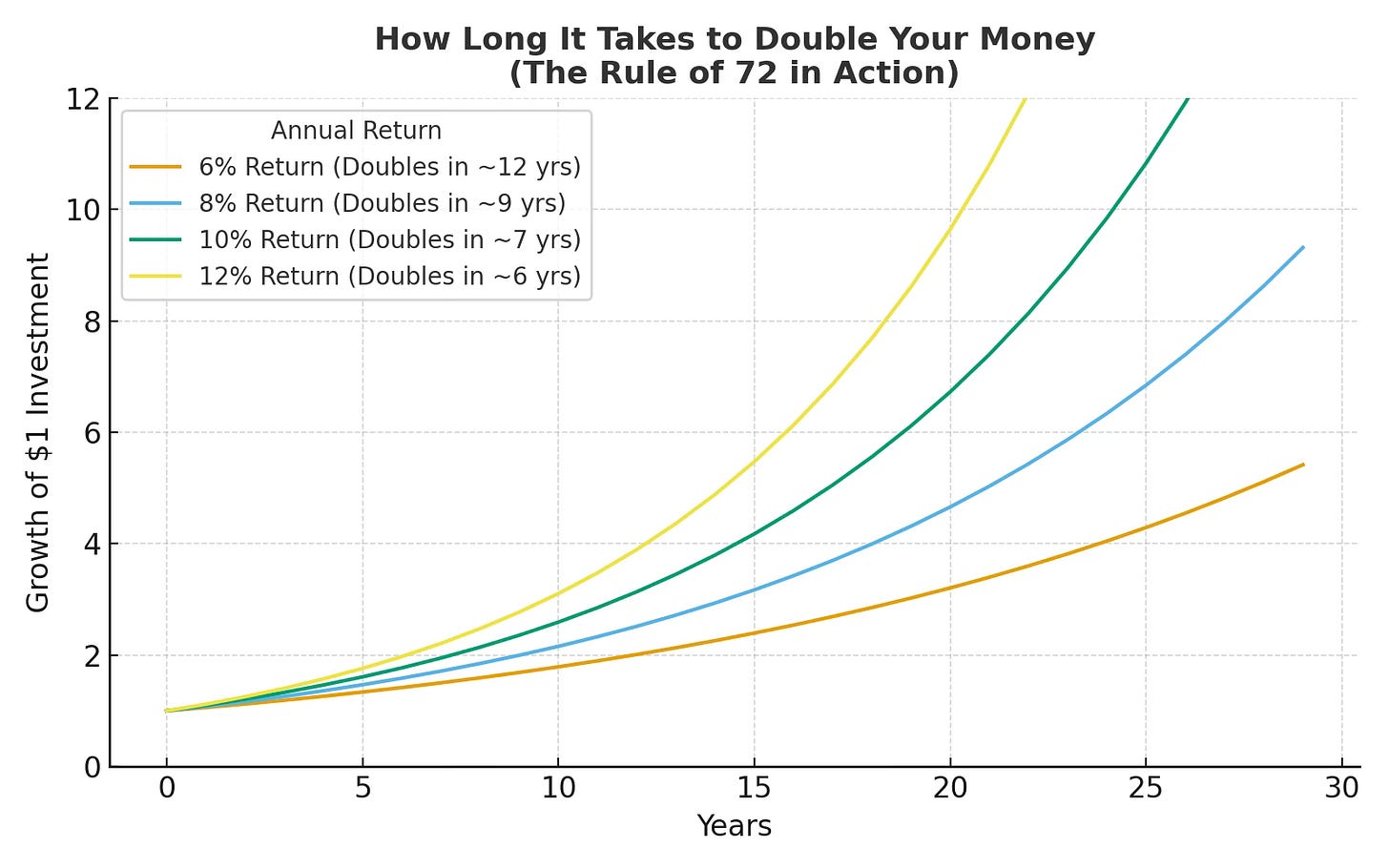

⌚️ 5. Be Patient (The Rule of 72)

The most underrated way to double your money: time.

Here’s how the Rule of 72 works:

Divide 72 by your annual rate of return to estimate how long it takes to double your money.

For example:

At a 10% annual return (the long-term average for the S&P 500), your money doubles roughly every 7.2 years. [Important: the long-term average returns of the S&P500 includes bear markets!)

That means $100,000 becomes $200,000 in 7 years, $400,000 in 14, and $800,000 in 21 - without leverage, luck, or lottery tickets.

Verdict: Compounding is the closest thing to magic in finance. You don’t need to chase risk - you just need to stay invested.

✖️2️⃣ Doubling Money vs. Doubling Wealth

Doubling your money is easy to brag about. Doubling your wealth is harder.

Many investors proudly share their biggest winners - not how much of their portfolio was in them. A 200% return on a 2% position doesn’t change your life.

True wealth is built by time in the market, not timing the market. Cashing out might feel peaceful, but getting back in is often where people stumble.

🌅 Your Time Horizon Is Your Superpower

If you’re in your 40s, 50s, or even 60s, you likely have multiple doubling periods left in your lifetime.

That’s the overlooked math of compounding:

You don’t need to double your money now. You need to double it enough times.

Why gamble with methods that depend on luck, access, or perfect timing - when time itself can do the heavy lifting?

✨ The Closing Thought

Doubling your money is about mastering the boring superpower of compounding.

Ignore the noise. Avoid the memes. Be patient.

Because the fastest way to double your money… is to stop interrupting it while it grows.

🚀 Up Next:

Sunday - “How to Set Investment Goals”

Thursday - “How to Detect a Bear Market”

This publication is for brains, not bets. The Other Side of Obvious shares ideas, stories, and general financial information—not personalized investment, tax, or legal advice. Investing comes with risk (including losing money). Talk to a pro before you act. Please take time to read these important disclosures before you get started.